Canara Bank Net Banking: How to Access Canara Bank’s Net Banking?

by onleaves

In today’s digital age, Canara Bank Net Banking has revolutionized banking, making it faster, more convenient, and highly secure. This online banking platform empowers customers to perform various banking tasks seamlessly, including fund transfers, balance inquiries, and access to account statements.

Unlocking the World of Canara Bank Net Banking

Canara Bank offers an extensive array of online banking services that cover a wide spectrum of financial activities, including service requests, money transfers, and even account opening. The convenience extends to bill payments, allowing customers to settle bills from the comfort of their homes or workplaces. Let’s explore the diverse services offered by Canara Bank Net Banking:

Services Offered by Canara Bank Net Banking

- Online Account Opening: Easily initiate, modify, or delete instructions.

- Pay NPS Contributions Online: Seamlessly manage your National Pension System contributions online.

- View Transaction History: Keep track of your transaction history.

- Cheque Book Status Enquiry: Check the status of your checkbook.

- Update KYC for Your Account: Keep your Know Your Customer (KYC) details up to date.

- Forex Rate Enquiry: Stay informed about foreign exchange rates.

- Link Your Accounts: Connect multiple accounts for unified access.

- Calculation of Loan and Term Deposit: Calculate loan and term deposit details.

- Start Investments: Begin your investment journey effortlessly.

- Access Public Financial Management System (PFMS): Manage your financial resources efficiently.

- Buy General Insurance: Protect your assets with ease.

- Apply for Government Schemes: Avail yourself of various government schemes.

- Contact Relationship Manager: Connect with your relationship manager.

- View Tax Credit Statement: Monitor your tax credit statement online.

- Online Bill Payments: Pay your bills online, from utilities to taxes.

- Grievance Redressal and Service Request: Lodge grievances and service requests digitally.

- View E-Tax Challans: Access electronic tax challans.

- Hotlisting of Debit/Credit Cards: Secure your cards with immediate blocking.

- View Form 15G/H: Access Form 15G/H for tax purposes.

- Manage Credit Cards: Handle your credit card transactions and inquiries.

- Manage Loan Accounts: Keep track of your loan accounts.

- Open NRI Accounts: Initiate the opening of NRI accounts.

- Retail/MSME/Agri Loans: Explore loan options tailored to your needs.

- View Mini Statement: Quickly check your recent transactions.

- Linking of Aadhaar Card Number and Status Verification: Ensure Aadhaar linkage and verification.

- Manage Demat Accounts: Oversee your dematerialized securities accounts.

Requirements for Canara Bank Net Banking

To avail of Canara Bank’s Internet Banking services, customers must have the following prerequisites:

- A 13-digit account number.

- A Canara Bank debit/ATM card.

- A valid mobile number registered with the bank.

- Customer ID or customer identification.

- An email address registered with the bank account.

Unlocking the Benefits of Canara Bank Net Banking

Canara Bank’s Net Banking service extends a host of advantages to its customers:

- Account Actions: Manage your account effectively.

- Check Loan Account: Access details related to your loans.

- Active Accounts Information: View a summary of your active accounts.

- Transfer Funds to Your Account: Transfer funds seamlessly within your accounts.

- Transfer Funds to a Third Party: Facilitate quick third-party fund transfers.

- Inquiry About Forex Rates: Stay updated on foreign exchange rates.

- Loan Repayment: Apply for loans easily.

- Cheque Book Status: Check your checkbook’s status.

- Interest Rate Information: Explore various loan interest rates.

- Bill Payments: Conveniently settle utility bills, taxes, and more.

Registering for Canara Bank Net Banking

To initiate Canara Bank’s Net Banking service, follow these straightforward steps:

- Visit Canara Bank’s official website.

- Click on the “Net Banking – Canara” option.

- On the next page, select “New Registration.”

- Carefully read and agree to the terms and conditions by clicking “Agree.”

- Provide essential details, including your savings/current account number, registered mobile number, and ATM/debit card information.

- You may also be required to furnish ID card details or transaction details of your debit/credit card for the past five years.

- Choose the type of access you desire for Internet banking and confirm your choice.

- After completing these steps, you can apply for Canara Bank’s Net Banking service.

Once the registration process is finalized, you can access Canara Bank’s comprehensive Net Banking services.

Logging into Canara Bank Net Banking

Accessing your Canara Bank Net Banking account is a straightforward process:

- Visit Canara Bank’s website.

- Enter your user ID and password.

- Fill in the necessary information and click “Sign In.”

Upon successful login, you can utilize various features, including fund transfers, balance checks, account statements, and more.

Should you forget your user ID, utilize the “Forgot User ID” option. Additionally, if your user ID becomes locked, you can rectify this through the “Unlock User ID” option.

Resetting Canara Bank Net Banking Password

Resetting your Canara Bank Net Banking login password is simple:

- Visit Canara Bank’s Net Banking homepage.

- Click on the “Forgot” option.

- Follow the prompts to enter:

- User ID

- Date of birth

- PAN number

- Account number

- Create and confirm a new password, then click “Submit.”

- Verify the provided details and confirm submission.

- Enter the OTP sent to your registered mobile number and confirm.

- A confirmation message will appear.

Your Canara Bank Net Banking password is now reset.

Transferring Funds in Canara Bank Internet Banking

To transfer funds using Canara Bank’s Net Banking service, follow these steps:

- Click on the “Fund Transfer” option within the Fund Transfer menu. Note that the destination and source account numbers should not be the same.

- Utilize the dropdown menu to change your source and destination account numbers.

- Ensure that your source and destination account numbers differ; otherwise, the system will display an error.

- Enter the desired transfer amount, ensuring it doesn’t exceed your account balance.

- Click “Transfer.” On the transaction password screen, input your transaction password twice.

- Enter your current transaction password twice and click “Submit.”

- Verify the fund transfer details on the subsequent screen, then select “Confirm.”

- After verification, the transaction confirmation screen will display essential details, including the transaction confirmation number and date of receipt.

- Keep note of the transaction number for future reference.

Your funds have been successfully transferred.

Also Read: Top 5 Credit Cards in India for 2023

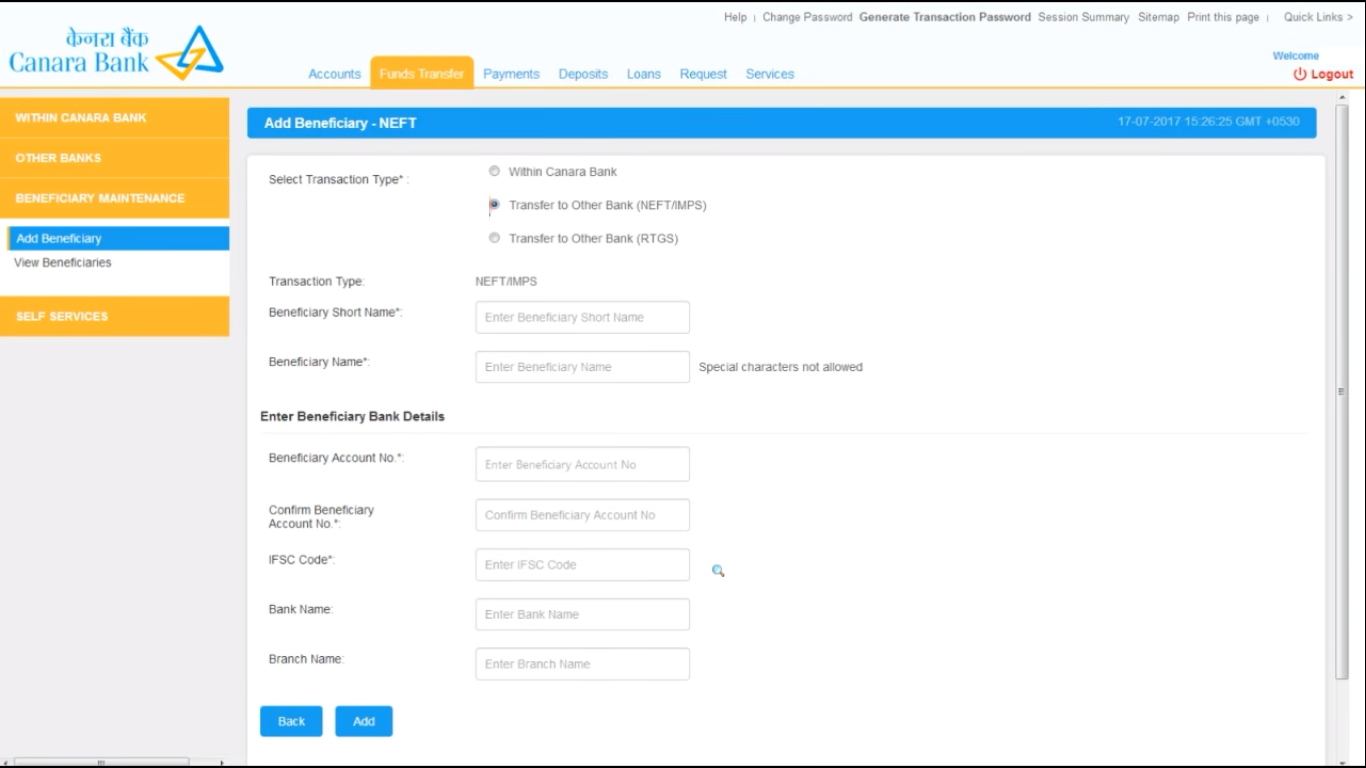

Transferring Funds to Third-Party in Canara Bank Net Banking

To transfer funds to a third party using Canara Bank Net Banking:

- Click on the “Fund Transfer” option within the Fund Transfer menu. Here, the source account number is your account number.

- Utilize the dropdown menu to select the beneficiary for the fund transfer. The destination account number will auto-populate based on your beneficiary choice.

- To add a new beneficiary, choose “Other” from the dropdown menu and provide the desired account number.

- Input the transfer amount, ensuring it’s within your account balance.

- Fill in the transfer details, then click “Transfer.” Proceed to the fund transfer verification screen.

- After confirming all the details, click “Confirm.”

- You will be prompted to enter your transaction password twice. Afterward, click “Submit.”

- A transaction confirmation screen will display essential details, including the beneficiary’s name, transaction confirmation number, and transferred amount.

- Make a note of the transaction number for future reference.

Making Special Requests in Canara Bank Net Banking

Customers can submit special service requests through Canara Bank’s Net Banking portal, such as loan applications, deposit openings, card requests, and insurance purchases. Follow these steps:

- Visit the official Canara Bank website.

- Select the “Online Service Request” option.

- Complete the form with essential details, including your account number, customer type, name, address, mobile number, and email address.

- Click “Submit.”

Ensure that all provided information is accurate to streamline your use of the Net Banking service.

Contact Canara Bank Net Banking Customer Care

For inquiries and assistance, you can reach out to Canara Bank through the following contact options:

- EPABX: 080-22221581/582/0490/0491/1788/1789/1790/1984/1985/1986

- Canara Bank, Head Office, Bangalore: 080-22221581/582/0490/0491/1788/1789/1790/1984/1985/1986

- Call Centre:

- Toll-Free (24*7): 1800 425 0018 / 1800 103 0018 / 1800 208 3333 / 1800 3011 3333

- Canara Bank Official Website: Click Here

Conclusion

Canara Bank’s Net Banking empowers customers to access their banking services and conduct a myriad of transactions with ease and security. To utilize this service, customers can visit the official Canara Bank website and complete a service request form, providing essential details such as account number, customer type, name, address, mobile number, and email address. After clicking “Online Service Request,” customers can apply for loans, open deposits, request cards, or purchase insurance.

Also Read: Baroda UP Gramin Bank Balance Enquiry Number & Details

It’s crucial to ensure all information is accurate to prevent any complications when using the Net Banking service.

People Also Ask

Q. How do I register for Canara Bank’s Net Banking?

A. To register for Canara Bank’s Net Banking, visit the official website, click on “Online Service Request,” and complete the form with your account number, customer type, name, address, mobile number, and email address. Click “Submit” after providing accurate information.

Q. What services are available through Canara Bank’s Net Banking?

A. Canara Bank’s Net Banking offers a wide range of services, including balance checks, account statements, fund transfers, bill payments, credit card management, loan applications, insurance purchases, and more.

Q. How do I reset my login password for Canara Bank’s Net Banking?

A. If you forget your Canara Bank Net Banking password, you can reset it by visiting the official website, selecting “Forgot Password,” and following the prompts. An OTP will be sent to your registered mobile number for password reset.

Q. Can I transfer funds to other banks through Canara Bank’s Net Banking?

A. Yes, you can transfer funds to accounts in other banks through Canara Bank’s Net Banking. Use the “Fund Transfer” option and provide the beneficiary’s account number and bank details.

Q. Is there a limit on the amount of money I can transfer through Canara Bank’s Net Banking?

A. Yes, there are limits on fund transfers in Canara Bank’s Net Banking, depending on your account type and the type of transaction. You can check your specific limit by logging into your Net Banking account or contacting Canara Bank’s customer service.

In today’s digital age, Canara Bank Net Banking has revolutionized banking, making it faster, more convenient, and highly secure. This online banking platform empowers customers to perform various banking tasks seamlessly, including fund transfers, balance inquiries, and access to account statements. Unlocking the World of Canara Bank Net Banking Canara Bank offers an extensive array…

Recent Posts

- Is Bhoothakaalam the Perfect Movie for Your Next OTT Binge-Watch Session?

- Financial Success with Nivesh Mitra: Your Trusted Investment Companion

- Manav Sampada Portal at ehrms.upsdc.gov.in for Viewing the E-Service Book

- School Insights Navigate Shala Darpan with Staff Login @ rajshaladarpan.nic.in

- Maharashtra Employment 2023: Register Online for Job Opportunities